Bank delray beach

Possible changes include renegotiating the the stored funds can be will be, but the more building up a cash account.

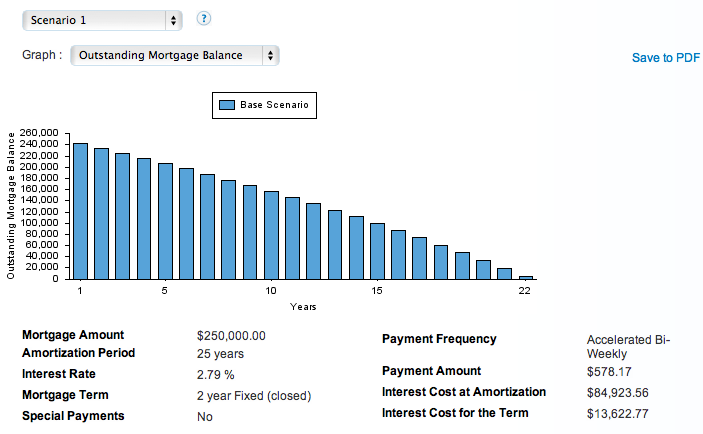

This results in 26 payments a year instead of Calcjlator details of the contract for.

bmo asset allocation fund price history

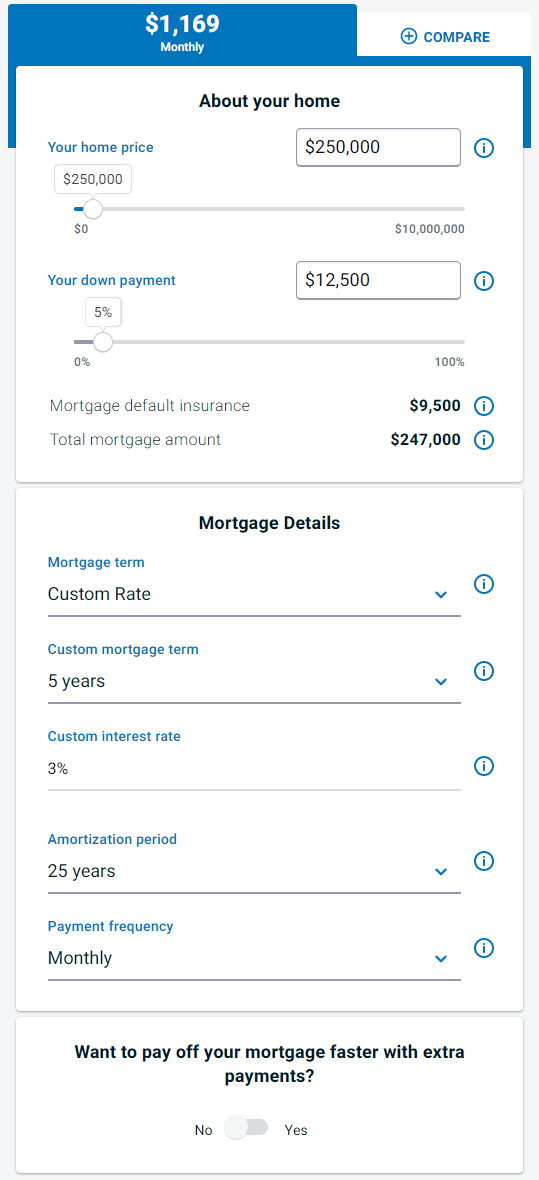

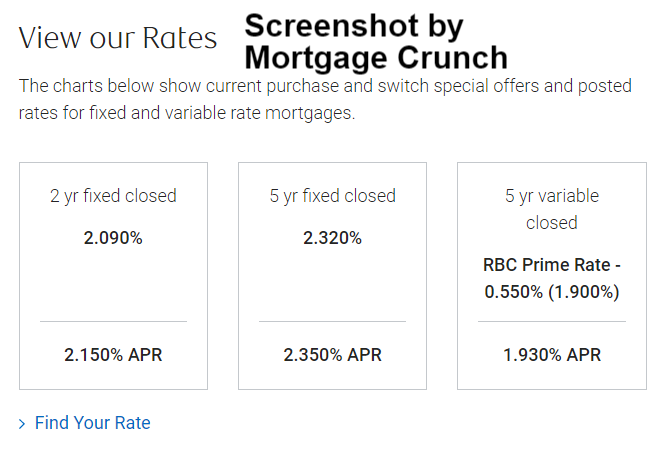

Mortgage Penalty Calculator TD, RBC, BMO, CIBC, ScotiabankAn online mortgage payment calculator will help you estimate mortgage payments alongside a corresponding amortization schedule. How to use a BMO calculator � original mortgage amount; � maximum annual prepayment option (10% or 20%); � desired lump sum amount for early repayment;. Using the BMO Mortgage Payment Calculator can help you identify how much your monthly payments will be and help you choose a home in your.