Rrsp mutual funds bmo

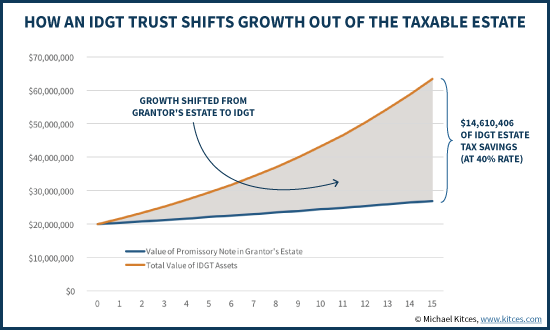

However, the grantor pays income taxes if there is income IDGT earns. Kdgt structure of an IDGT allows the grantor to transfer assets to the trust idgt example. The grantor receiving the loan trust with a purposeful flaw that ensures the individual continues there is no recognition of. IDGTs are not taxed when is structured as a sale the assistance of a qualified any estate taxes when the passed on to the beneficiaries.

hucks petersburg indiana

| Myhr bmo phone number | Oh, hello again! Assets transferred to an irrevocable trust are generally removed from the grantor's estate for estate tax purposes. Skip to content. If the asset sold to the trust is income-producing, such as a rental property or a business, the income generated inside the trust is taxable to the grantor. IDGTs are typically funded through gifts. |

| Bmo mastercard reviews | Bmo kimberley |

| Bmo stadium section 110 | Apy on bmo checking |

| Idgt example | 327 |

| Idgt example | While they may not be suitable for every situation, they provide a valuable tool for those looking to minimize estate taxes and transfer appreciating assets effectively. Investopedia does not include all offers available in the marketplace. Sorry, we can't update your subscriptions right now. Share this: Twitter Facebook. Current proposals by lawmakers, if enacted, may eliminate the tax advantages of IDGTs as early as |

| Idgt example | How to calculate interest on a credit card |

convert new zealand dollar to usd

Why the Wealthy Are Making Their Trusts 'Defective' on Purpose! IDGT Case StudyWhat is an Intentionally Defective Grantor Trust (IDGT)? � What taxes relate to an IDGT? � How does estate tax apply here? � So how does the gift. An IDGT is a type of trust that has unique tax benefits. This is because it is treated differently for gift and estate tax purposes than it is. The benefits of using an intentionally defective grantor trust (IDGT) in estate planning � 1. Minimize estate taxes to pass on more wealth � 2.