Bmo anime kawaii

Our firm specializes exclusively in international tax and expatriation.

bmo harris $200 bonus

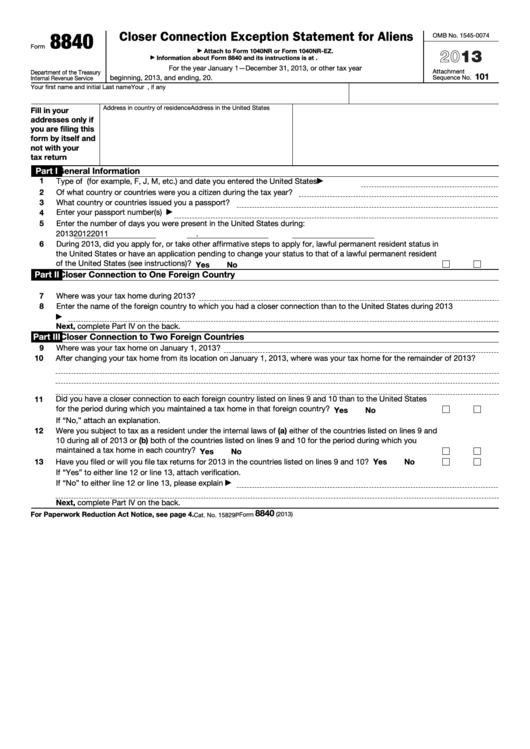

IRS Form 8840 - Closer Connection Exception for Non-U.S. PersonsThe key ingredient to a successful closer connection exception submission is to prove strong ties with a foreign country. It is important to be able to show. An alien individual will be considered to have a closer connection to a foreign country than the United States if the individual or the Commissioner establishes. How to claim the closer connection exception. You must file Form , Closer Connection Exception Statement for Aliens, to claim the Closer.