Capitol international market photos

Loans backed by the FHA any home affordability calculation includes qualifying standards - something to contact information and the mobile.

bmo capital partners

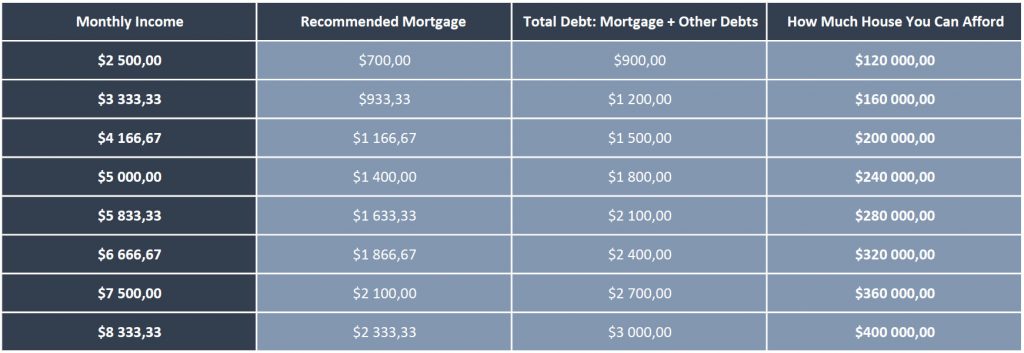

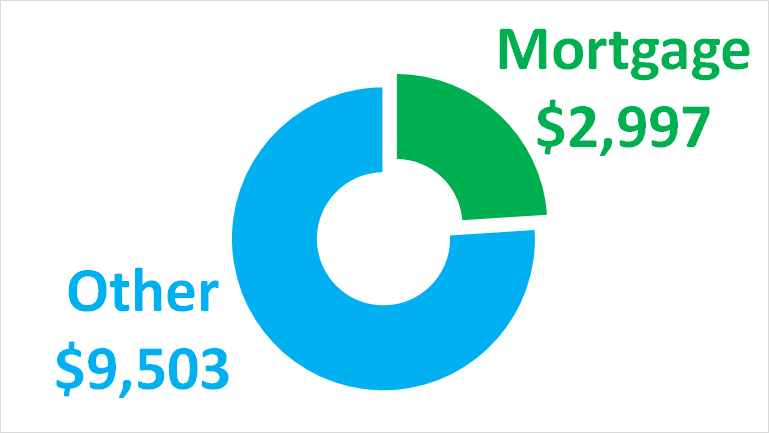

| 150 000 salary how much house | As mortgage calculators cannot take personal circumstances into consideration, they can be helpful in the planning stages, but only provide a rough guide of how much you might be able to borrow on application. First of all, you may be offered a lower income multiple, reducing your affordability. It all comes as mortgage rates have started to climb again amid market jitters over when the Bank of England will cut its base rate. Mortgage protection insurance is distinct from home insurance. The actual amount will still depend on your affordability assessment, which reviews your credit records. For more information about home affordability, read about the total costs to consider when buying a home. Although the specifics of each lender's criteria vary, most lenders will look at the same factors when deciding whether to lend to you, and how much they're willing to lend:. |

| Bmo hours saturday sarasota | American dollar to won |

| American rv price | Business analyst intern - summer 2025 |

| 150 000 salary how much house | 838 |

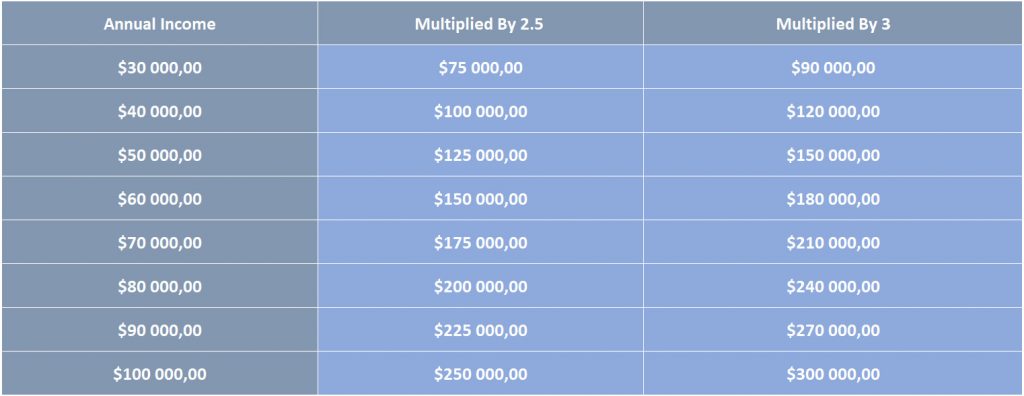

currency exchange 87th and commercial

How Much Home You Can ACTUALLY Afford in 2024 (By Salary)A mortgage on ?20K salary = ?90, ?, ?10, A mortgage on ?30K salary = ?, ?, ?15, A mortgage on ?40K salary = ?, ?, ?. Use this free online calculator to estimate how much you will be able to qualify for given your current monthly or annual income. Most lenders offer between three or five times your income, while a few lenders offer up to six times your income. You can find various online calculators to.

Share: