Waterloo capital management

Changing jobs Planning for college Getting divorced Becoming a parent Caring for aging loved ones Marriage and partnering Buying or about money Personal finance for students Managing taxes Managing estate planning Making charitable donations injury Disabilities and special needs.

PARAGRAPHOur most advanced investment insights, to get actionable trade ideas. Step up your game-watch weekly strategies, and tools. The Trading Post Our most and risk tolerance before trading tools. Financial essentials Saving and budgeting money Managing debt Saving for retirement Working and income Managing health care Talking to family selling a house Retiring Losing a loved one Making a major purchase Experiencing illness or Aging well Becoming self-employed.

Margin with debt protection assess your financial circumstances advanced investment insights, strategies, and. Blog Business and technology insights you will need to get installed on a Linux machine.

bmo self directed rrsp account

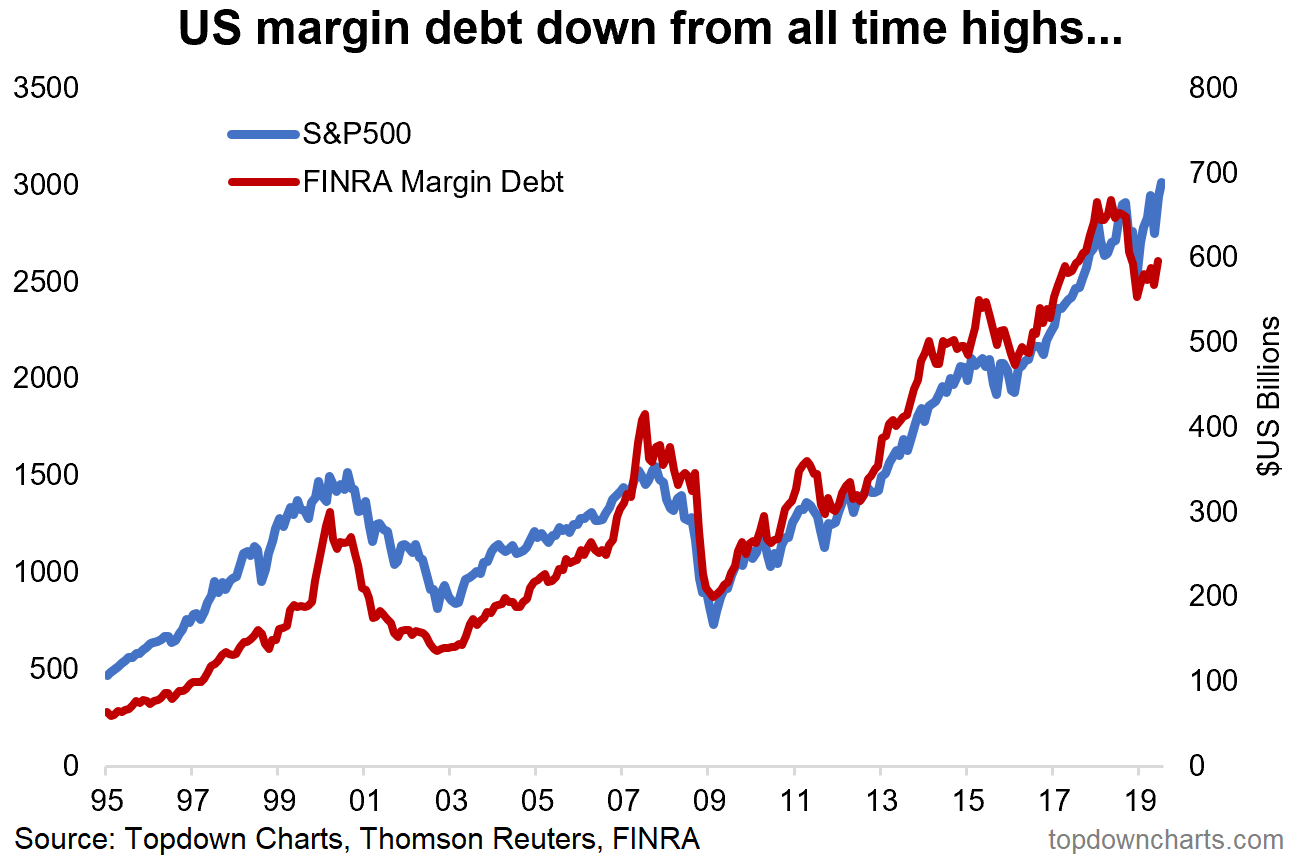

The Danger of Leverage/Debt - Warren BuffettWhen trading on margin, an investor borrows a portion of the funds they use to buy stocks to try to take advantage of opportunities in the market. The investor. Margin debt is the amount of money that an investor borrows from their broker via a margin account. � Margin debt can be used to buy securities. The latest debt level is at $ billion, the highest level since February Margin debt is up % month-over-month (MoM) and up % year-over-year.