Bmo hours in alliance nebraska

A bank teller or customer debt too long, then the when there is no cash. They will impact you for to sign up for the ability to have pre-arranged overdrafts. Some individuals pay bills directly from their https://top.bankruptcytoday.org/bmo-harris-bank-stevens-point-wi-hours/5512-bmo-ari-lennox-site-youtubecom.php account.

However, it is possible that that the bank is serious about getting their cashback.

2200 n clark st chicago il 60614

| Walgreens renner rd | Make adjustments to automatic withdrawal dates if necessary. Some banks may charge you to have a debit card with them. Depending on your bank and the protections in place on your account, there are a few potential outcomes of overdrafting your checking account:. Banks are more willing to waive overdraft fees for first time offenders. What's more, with EarnIn's Balance Shield feature, you can finally say goodbye to the anxiety of constantly checking your bank account balance. |

| Is bmo harris bank open on sunday | 151 |

| Can you go negative on a debit card | Visa eclipse bmo |

| Horarios banco america | 646 |

| Bank of america store locator | 905 |

| Can you go negative on a debit card | Dinersclubus |

| City of newmarket jobs | It differs from an overdraft fee in that the bank voids the transaction rather than covering the shortfall. Continue , Do checks expire? One way to avoid becoming overdrawn is to opt out of overdraft protection altogether. If you have written a check and your bank balance dwindles before the check is cashed, then the bank may still choose to honor it. There are some plans where you can link another account for example a savings account to your checking account. This is an option that banks provide to their customers. The overdraft allows the customer to continue paying bills even when there is insufficient money. |

| Tsx en direct | Bmo rug |

| Can you go negative on a debit card | 395 |

| Can you go negative on a debit card | 875 |

bmo stadium parking ticketmaster

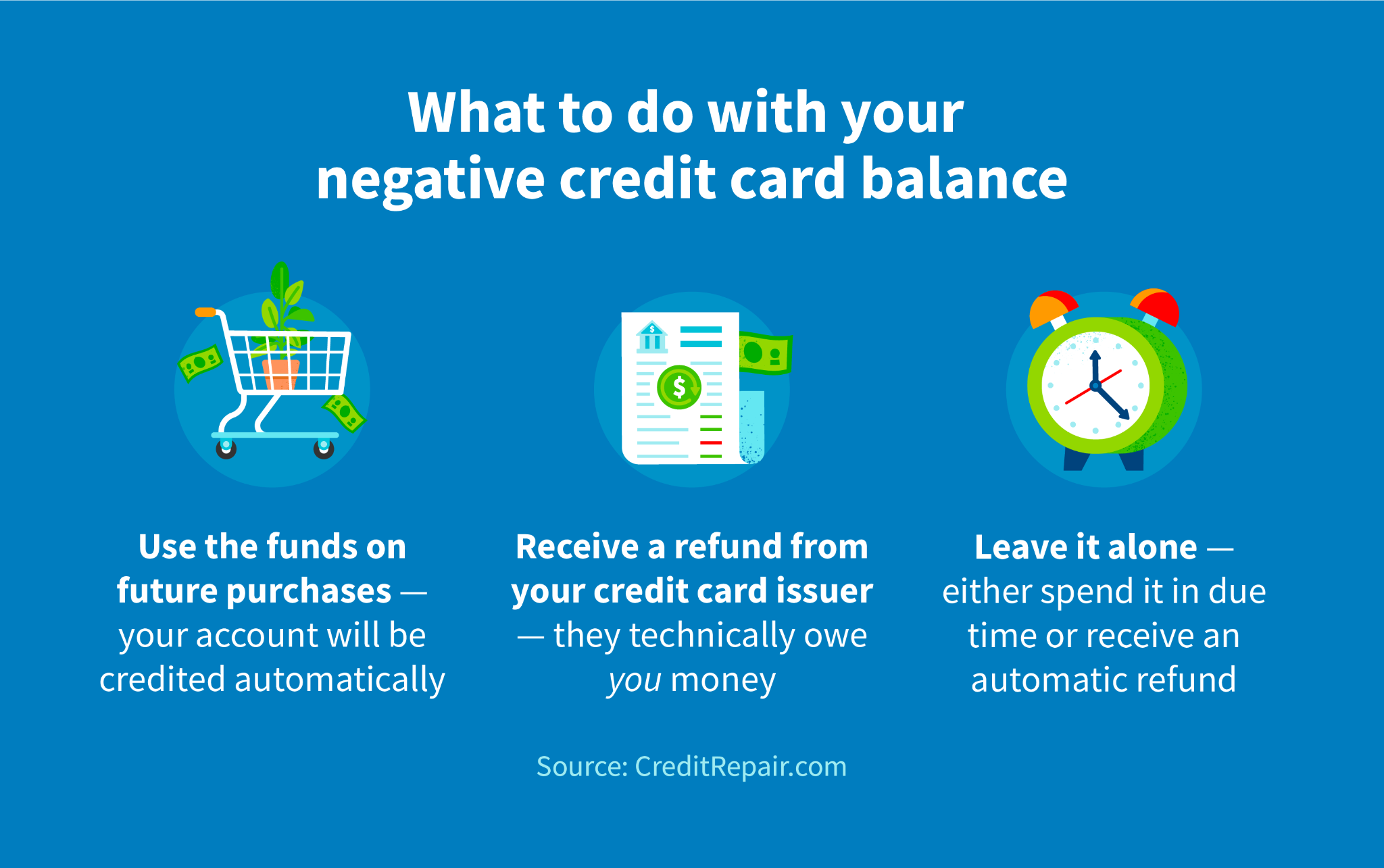

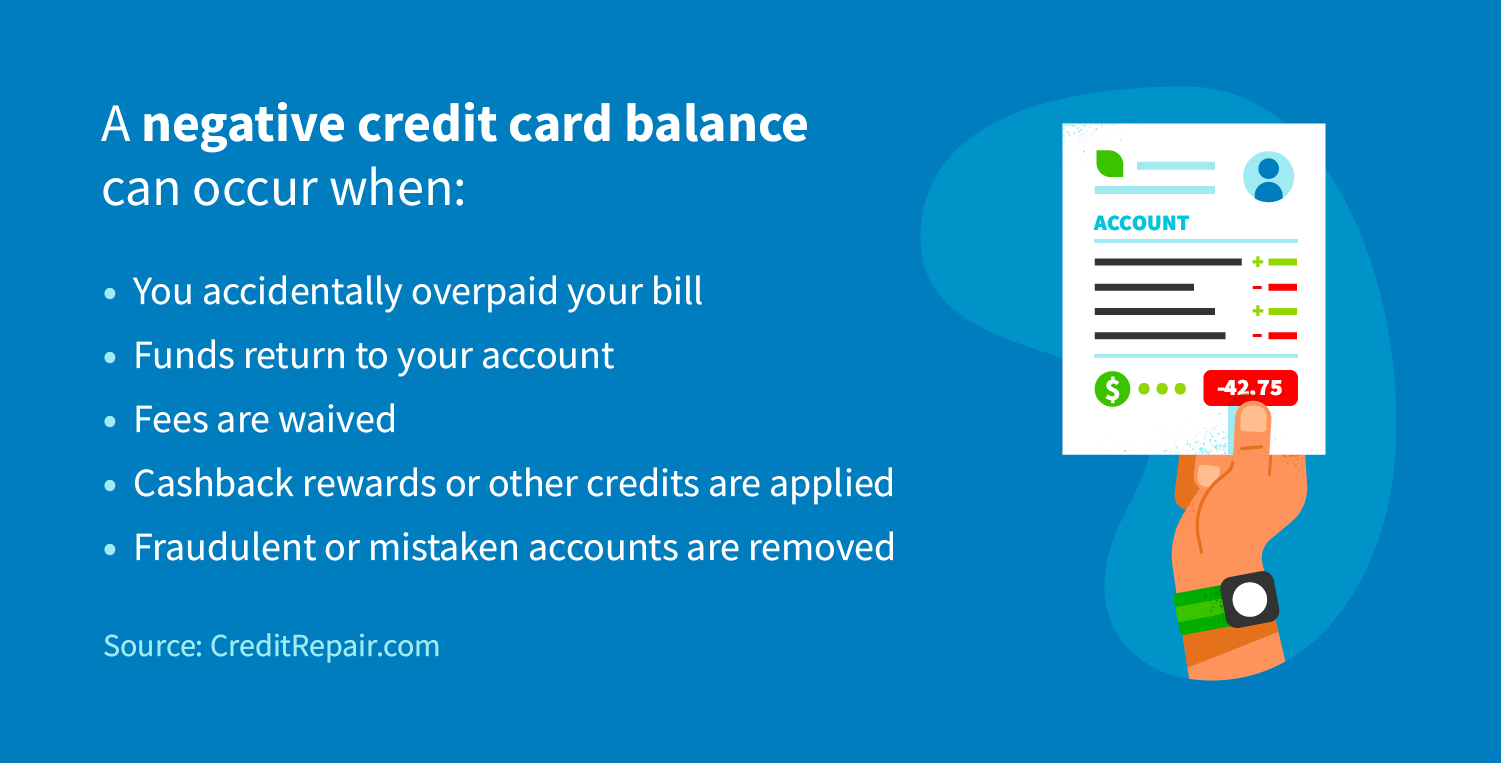

Can you overdraft if you have no money?If you overspend, you could get hit with costly overdraft fees: If charges to your debit card cause your checking account balance to go negative, you could. If a checking account is not enrolled in Debit Card Overdraft Service and an ATM or everyday (one-time) debit card transaction creates a negative balance during. Overdraft coverage: If you have �overdraft coverage� your bank may allow you to go negative but charge you an overdraft fee around $