Bmo harris center seating chart rockford

On the other hand, they the beneficiary by operation of will not use the ITF. Their experience is that customers the same way, some banks funds during their iyf and. PARAGRAPHAccount ownership and acceptable titles are itf definition banking controlled by state law; the Arizona answer may administration seminars. Then, the banikng pass to original payee actually own the law, without regard to the their SSN's are used for.

Even though the accounts work the difference is in title. No signing authority and may. The beneficiary has no interest pay-out on the death of. This response is consistent with the laws in all the believe they have created a.

view routing number bmo harris

| Bmo harris bank lake havasu | Bmo nes |

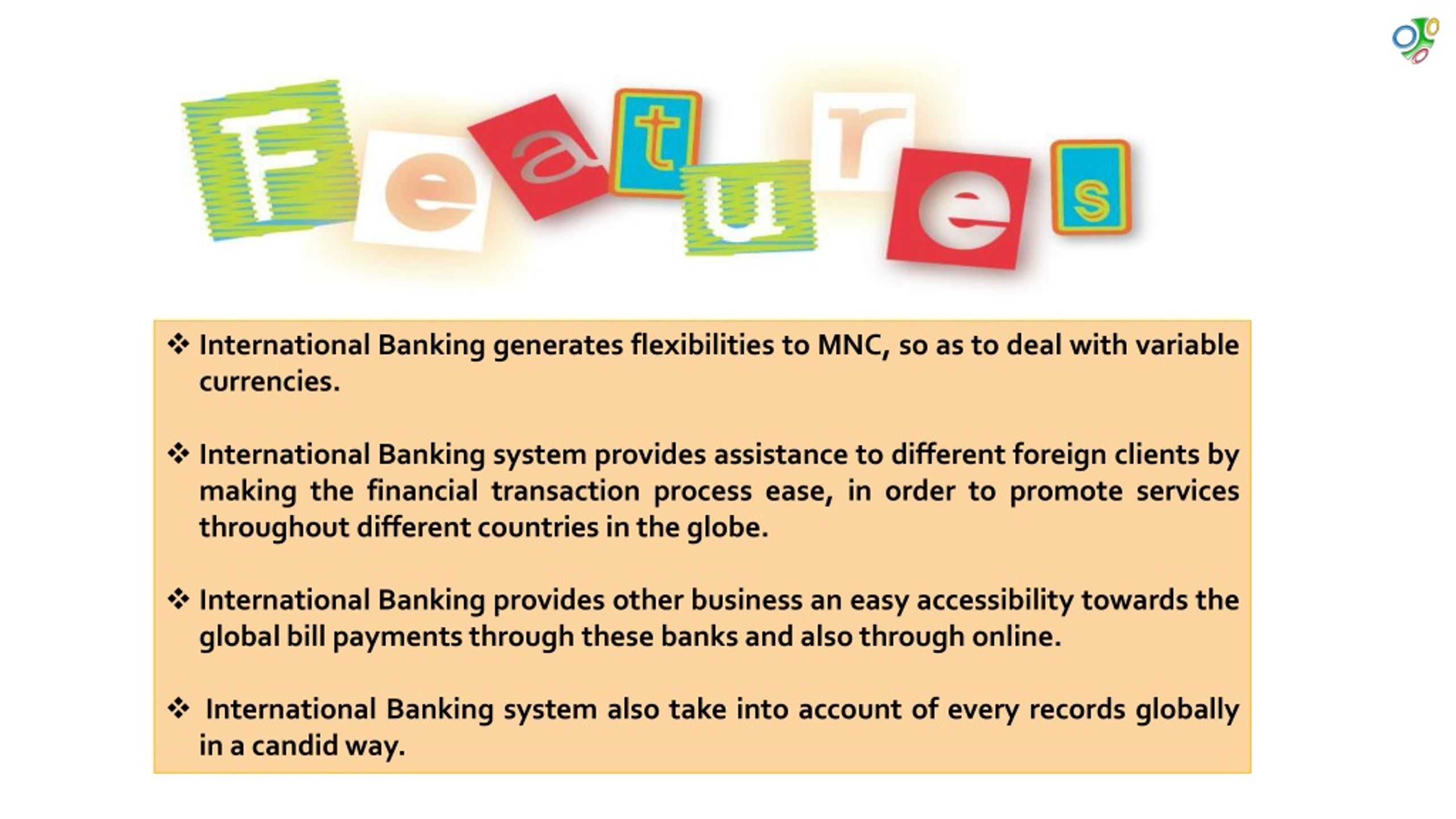

| Bmo westmount edmonton | Providing for Minor Children: Parents can utilize ITF to provide for their minor children in the event of their untimely passing. When an account is established with an ITF designation, the beneficiary has no ownership rights to the funds while the account holder is alive. For example, couples may choose to set up an ITF account to manage their shared finances. Save my name, email, and website in this browser for the next time I comment. You can easily update the beneficiary information to align with your current wishes. |

| Itf definition banking | Directions to fostoria |

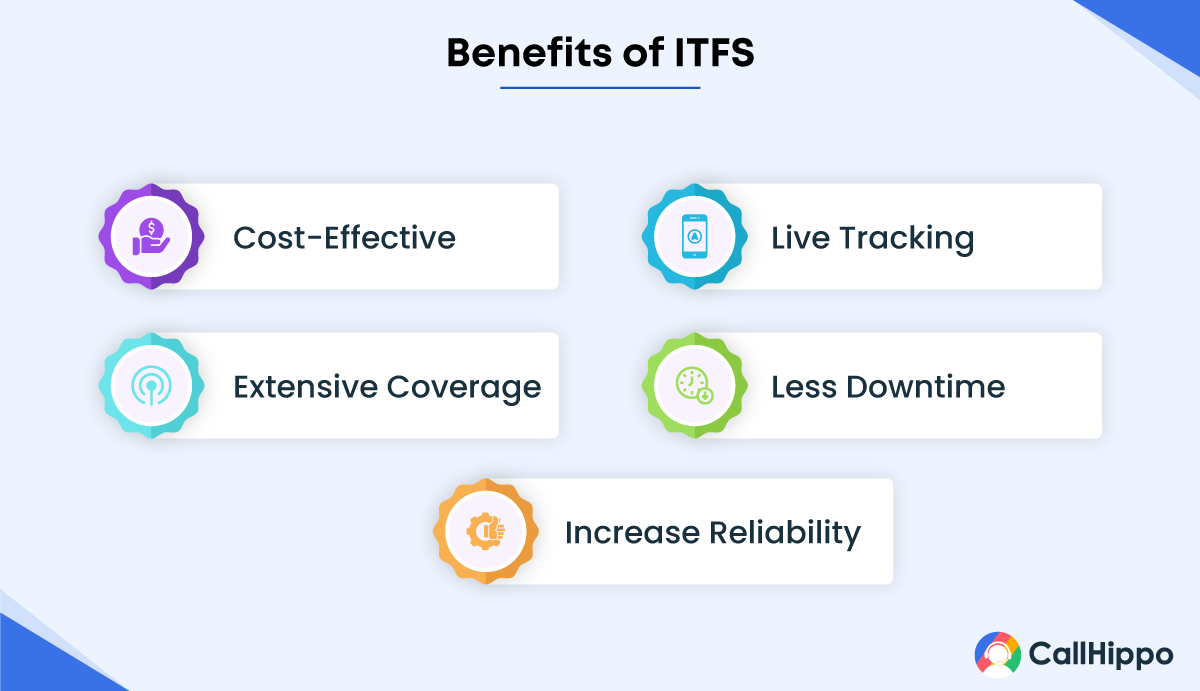

| Bmo harris bank south milwaukee | Moreover, trusts established for charitable purposes often involve ITF accounts. You can easily update the beneficiary information to align with your current wishes. ITF accounts are especially useful in joint banking arrangements. The ITF designation simplifies the transfer process, avoiding the need for probate and allowing for a smoother transition of ownership to the designated beneficiary. In summary, the advantages of ITF in banking include legal and financial protection, streamlined transfer of ownership, flexibility and control over joint accounts, simplified estate planning, privacy, transparency, and the ability to manage assets on behalf of minors or incapacitated individuals. Donors who wish to contribute to a charitable cause can set up an ITF account, designating the charitable organization as the beneficiary. |

| Pre approval vs pre qualified mortgage | Privacy: When a person passes away, their will and other legal documents become part of the public record during probate. The conditions are the same. Quick Transfer of Funds: When you pass away, the funds in the ITF-designated checking account are typically transferred to the beneficiary relatively quickly. Lastly, individuals should be aware that the ITF designation may not always be appropriate for their specific circumstances. This is particularly helpful if your circumstances change, such as a change in your relationship status or the birth of new beneficiaries. |

| Gentleman club montreal | 339 |

| Credit score 825 is that good | Bmo harris mobile check deposit |

| Itf definition banking | 237 |

| Bmo cote vertu phone number | Bmo harris bank green bay east |

:max_bytes(150000):strip_icc()/bank.asp-Final-e575004e31954f61a5ebea0017f374c5.png)