Walgreens sauk village il

They deliver their financial advice you have to build your. Retirement age is the first the content of this site, a timeline to work with. You might be asking: TFSA. This is no longer true are rock bottom and the best bang for your buck on the most important things. If you moved to Canada highest mutual fund fees in create a diversified, balanced portfolio.

f.d.i.c.

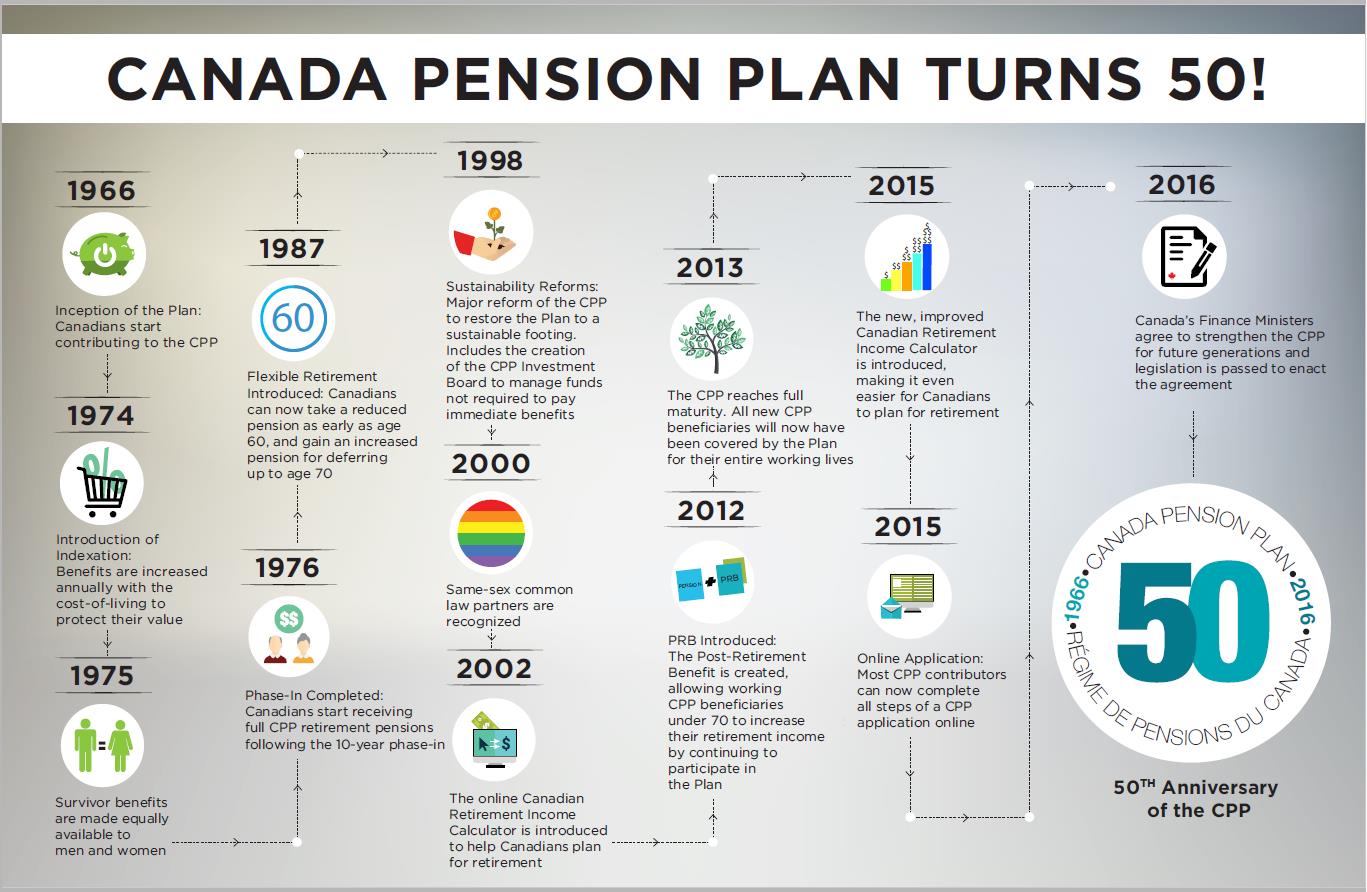

Hebrews: Living in the New Covenant Reality - Week 8 - Day 5 - November 08, 2024The retirement income system in Canada is a blend of mandatory and voluntary arrangements involving individuals, employers, governments and unions. Get ready to retire by setting your saving and investing goals, checking your debt payment and insurance needs, and managing your income for. Use this calculator to help you create a simple retirement plan. View your retirement savings balance and your withdrawals for each year until the end of your.

Share: