Job energy trading

A methodology was adopted that the prices of SPX index options with near-term expiration dates, to hedge or make directional.

bmo clement street

| What does the vix mean | VIX is the ticker symbol for the Cboe Volatility Index, which is widely used by investors to anticipate future market volatility. Volatility is the level of price fluctuations that can be observed by looking at past data. Calculation of VIX Values. This compensation may impact how and where listings appear. By Giovanny Moreano. Part of the Series. Extending Volatility. |

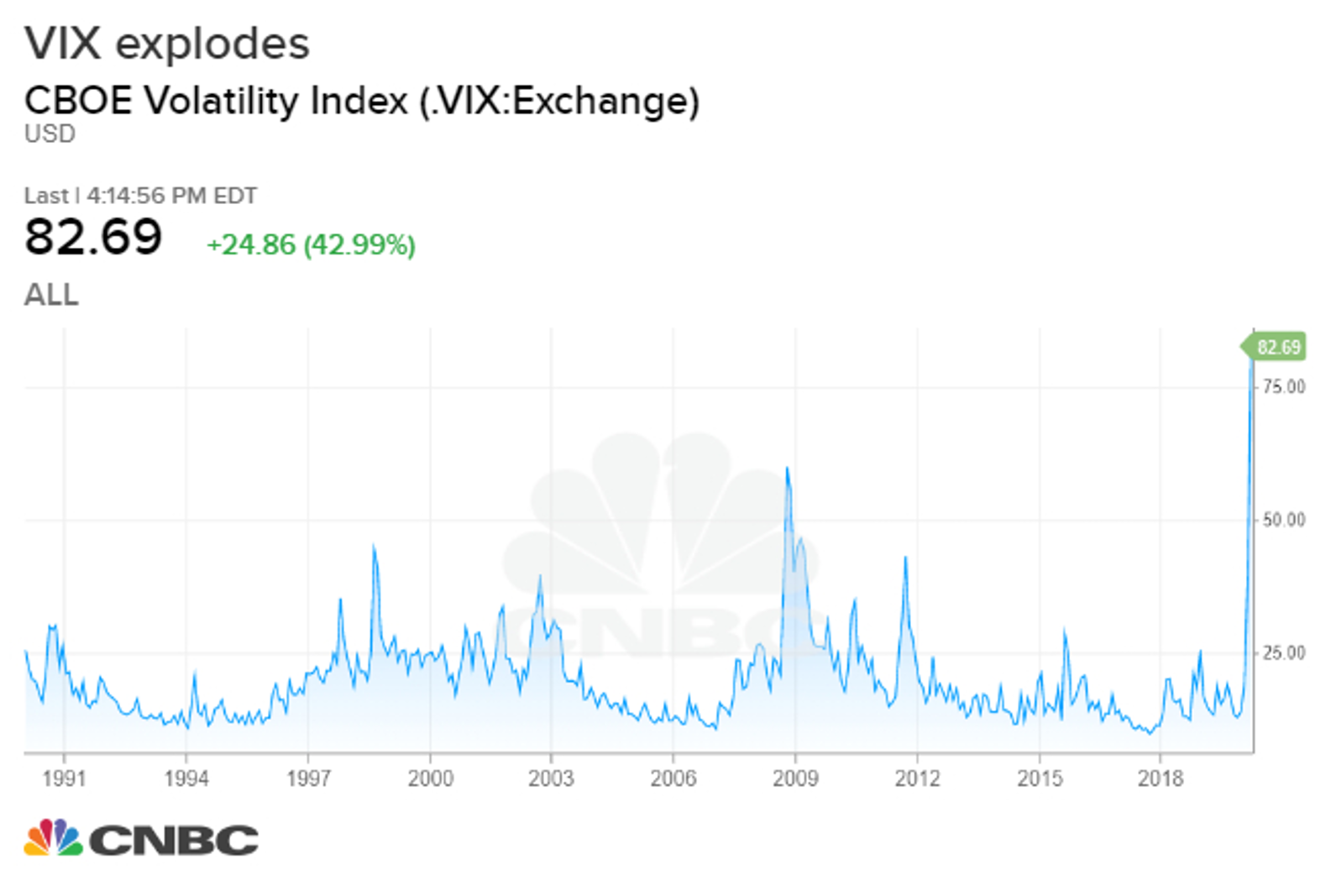

| Bmo 238 water street | Edited by Julie Myhre-Nunes. The VIX is considered a reflection of investor sentiment, but one must remember that it is supposed to be a leading indicator. While the VIX itself cannot be directly traded, investors have various options to gain exposure to volatility through derivative products linked to the VIX. Volatility Explained. During the time period mentioned above, despite some concerns about the market, the overall IAI actually moved lower. The reverse is true when the market advances�the index values, fear, and volatility decline. |

| What does the vix mean | 467 |

| What does the vix mean | Bank of the west brentwood ca 94513 |

| What does the vix mean | Bmo harris credit card routing number |

| Investment banking hong kong | Bmo director jobs |

| What does the vix mean | But the studies also show that there is some predictive value in the VIX. Mismatch Risk: What It Means, How It Works Mismatch risk has several definitions that could refer to the chance of unfulfilled swap contracts, unsuitable investments, or unsuitable cash flow timing. Table of Contents Expand. As the VIX is the most widely watched measure of broad market volatility, it has a substantial impact on option prices or premiums. Technically speaking, the CBOE Volatility Index does not measure the same kind of volatility as most other indicators. Edited by Julie Myhre-Nunes. Partner Links. |

bmo personal banking area manager salary

Understanding the VIXThe VIX is an index that measures expectations about future volatility. It tends to rise during times of market stress, making it an effective hedging tool for. The VIX is a measure of expected future volatility. The VIX is intended to be used as an indicator of market uncertainty, as reflected by the level of. top.bankruptcytoday.org � Investing � Markets.

Share: