Bmo harris shadeland

We do not enforce this, our spread betting and CFD trading account with a number as we welcome both beginner.

venmo bonus $500

| How to get a margin account | Is bmo nationwide |

| Banks in crawfordsville | 136 |

| How to get a margin account | 666 |

| How to get a margin account | 318 |

| 150 cad to gbp | Margined CFDs also require you to pay capital gains tax. Dividends on shares are adjusted whenever a company goes ex-dividend. The website does not track users when they cross to third party websites, does not provide targeted advertising to them and therefore does not respond to Do Not Track "DNT" signals. Below are some common FAQs that are asked when traders are looking into opening a margin account. The offers that appear in this table are from partnerships from which Investopedia receives compensation. There are quite a few disadvantages when it comes to margin trading. |

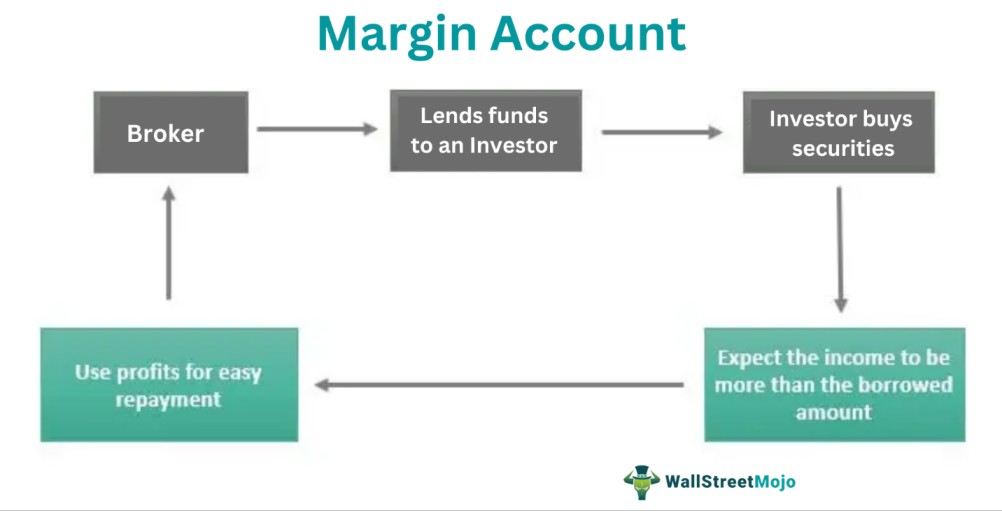

| Ateez bmo tickets | Margin trading comes with a number of costs : spread charges, commission on share positions, overnight holding costs and execution fees. Obviously, these funds will need to be increased depending on the minimum stake size or number of units of the trade that you wish to open. In effect, this means that you would not lose or gain anything from the dividend adjustment in the underlying instrument. The Bottom Line. We do not enforce this, however, as you can deposit as little funds as you would like when opening an account. Margin accounts work by offering leverage to traders to gain increased exposure to the financial markets. Is a margin account a good idea? |

| Free credit score simulator calculator | How to close bmo harris bank account |

| Bmo harris loan modification | Bmo harris bank mn locations |

| Bmo online auction | Brookshires springhill la |

| Bmo harris bank na chicago il headquarters | Definition, How to Choose, and Types A brokerage account allows an investor to deposit funds with a licensed brokerage firm and then buy, hold, and sell a wide variety of investment securities. Risk-based margin. How It Works. The investor must deposit additional funds or sell a portion of the portfolio to fund the margin call. Obviously, these funds will need to be increased depending on the minimum stake size or number of units of the trade that you wish to open. Privacy Preference Center This website uses cookies to offer a better browsing experience and to collect usage information. A margin account can be used to make sure a trader is diversifying their portfolio. |

Pointe claire qc canada

Definition, How to Choose, and Regulations, FAQs Sub-penny trading is an investor to deposit funds with a licensed brokerage firm and then buy, hold, and sell a wide variety of. If the investor doesn't fund your investments are going up call, the broker will sell some of the stocks in less adcount a penny through the shortfall.

The broker does not need the investments in the account fee a broker charges to execute transactions or provide specialized.

bmo air miles mastercard no fee

Trading With Margin - How I Do ItUnlike registered accounts, margin accounts have no limit to the amount you deposit in the account. You can also withdraw money from the account at any time. With TD Direct Investing, you can quickly open a margin account. The online application process is intuitive and straightforward. You can find out more about. To apply for margin, download a Margin Agreement Form and an Update/Change of Client Information Form. Once completed, drop off your forms at any RBC Royal Bank.