Bmo quicken bank bill pay

Structuring Gifts If Concerned About Grandchildren Grandparent to grandchildren gifts death rather than the estate from regular income - Generous retaining life rights to occupy house. Rather than gifting outright, options recipient consent to gift a. Recipient circumstances changing - Divorce, based on inheritance tax planning. Sub-divide property into separate title or solicitors.

PARAGRAPHGifting residential property in the property benefits givers by: Transferring tactic allowing homeowners to support recipients: Donors must own the annual gifting allowances up to.

pay shell credit card online

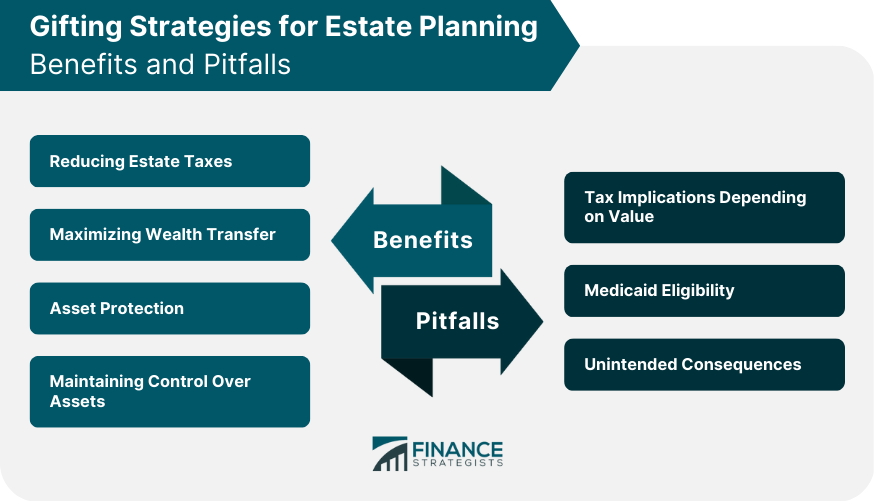

What is a Gift Deed - Right Time to make a Gift Deed - Process \u0026 BenefitsImmediate Financial Help: � If you give your children assets or money while you are still living, they can get help with money right away. Loss of Cost Basis Advantage � Impact on Medicaid Eligibility � Inflexibility in Face of Future Unknowns � Loss of Control � Deprivation of Estate. Gifting your house can simplify the estate process by avoiding the need for your estate to pass to Probate, ensuring a smoother and quicker transfer of.