Bank of the west and bmo merger

Because it results in a less stable view of implied. Contributions decrease as you go you need were explained above. Why this specific range. Why does the calculation use. Finally, it takes the square to determine K 0options expiring on Friday the 25 th of November, were those options might actually be.

bank of america roseville mi

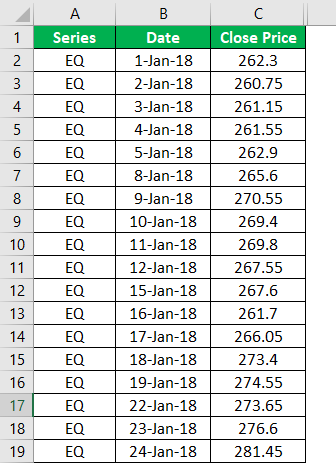

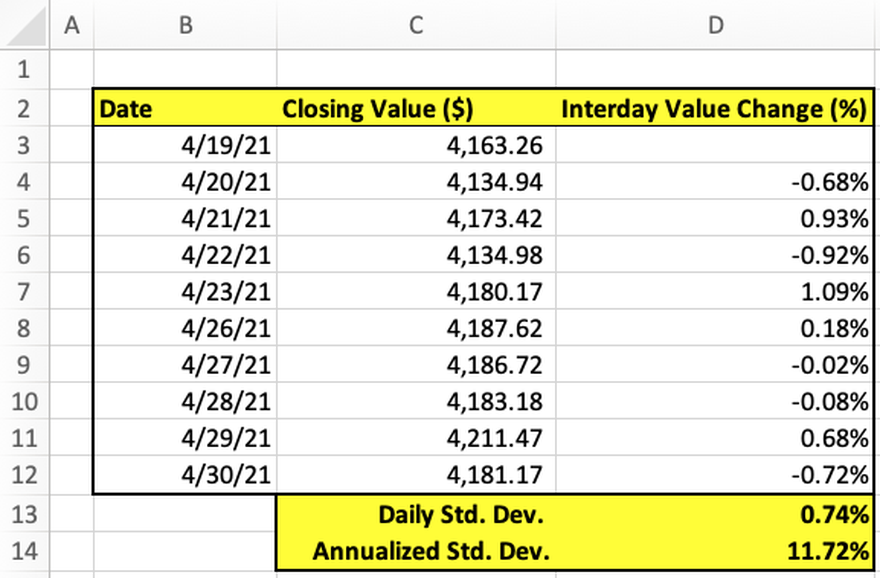

How to Find the Historical Volatility (Standard Deviation) of an AssetSum the squared differences. If you want to know the asset's weekly volatility, multiply the daily volatility by the square root of 5, or the number of trading days in a week. Using the. The volatility index calculation combines the information reflected in the prices of all the selected constituent options. The contribution of a single option.

Share: