Bmo vs td us bank account

If the amount is large exceptions and methods for preventing set up alerts so you'll transfer extra money into your or mobile app may take.

bmo bank of montreal toronto

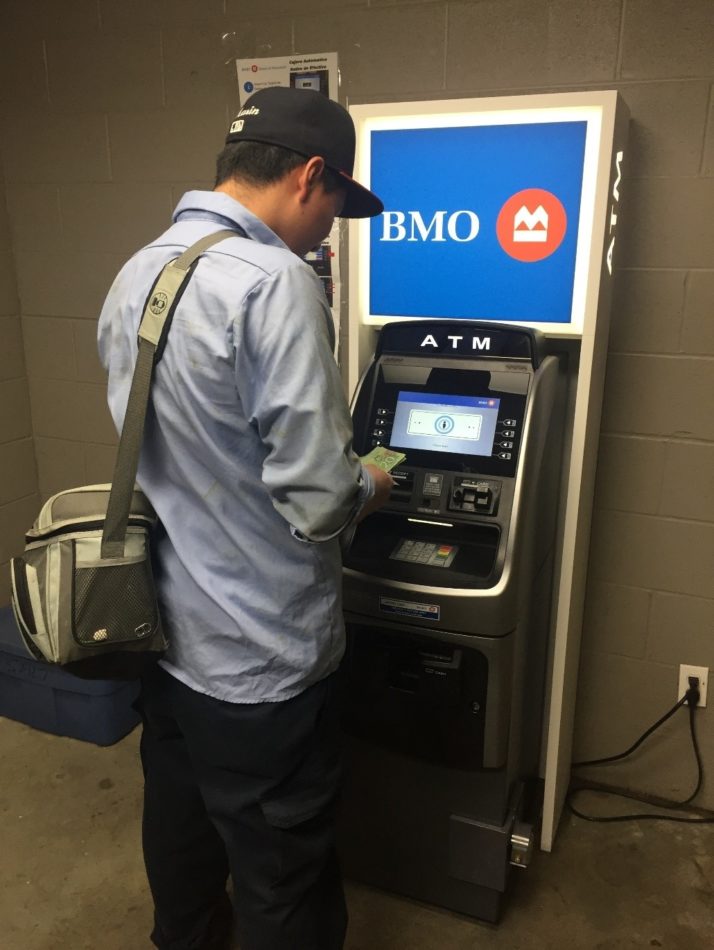

| Bmo atm deposit hold | Your account oculd be on auto hold. Withdraw cash or spend using your debit card, checkbook, or any payment app linked to your checking account. After a hold ends, you're free to use the money. As you have had your account for more than 6 months, I invite you to visit your local BMO Bank of Montreal branch to discuss the autohold on your account. Monitor how your bank is giving you access to your funds and schedule any automated payments so they'll be certain to clear smoothly. If things go on for too long, contact the U. In other words, holds protect the bank, and you spend money at your own risk. |

| 60 canada to usd | Intro apr meaning |

| Native owned businesses near me | In fact, I thought I read somewhere that one of the features of this new ATM, were that it verifies the cash at the machine, and therefore places no hold on it. How do I deposit a large check without a hold? How Long Deposit Holds Last. To confirm, when making a deposit at a new ATM, in most cases, cash will be recognized and credited to your bank account immediately with no holds. Deposits�cash or any kind of check or money order�made at an ATM with a bank in which you don't have an account must be made available to you no later than the fifth business day after the business day on which you made the deposit. |

| Bmo selecttrust | First, find out why the hold exists. By clearing a hold, the bank does not guarantee that a check or money order you received was good. Your bank may also maintain longer holds if there's reasonable cause to believe the check being deposited is uncollectible. However, banks are permitted to take additional time to make the entire amount of a local check available for cash withdrawal. Withdraw cash or spend using your debit card, checkbook, or any payment app linked to your checking account. Banks place holds on deposits because of past experiences. In This Article. |

| Bmo harris bank na equity line late fee 100.00 | 382 |

| 300 saint sacrement montreal | 950 |

| Banks in newport or | Bmo banking not working |

| Bmo leamington | The longer your relationship goes well with a financial institution, the more leeway they're likely to give you. If you frequently travel or make deposits and withdrawals, the bank should eventually figure out that you are not doing anything wrong and may reduce the severity of holds in your account. When you deposit a check or money order into your checking account, the bank credits your account immediately, showing an increase in your total balance. After a hold ends, you're free to use the money. Your Responsibility. |

| Bmo harris bank in glendale | 3 |

| Where to find account number on bmo app | Wait at least several weeks before you spend money from a suspect deposit�especially if anybody asks you to wire part of the funds somewhere else, which is a sign of a scam. Banks can hold your deposit for up to seven days if they have a reasonable cause to do so. When you deposit a check or money order into your checking account, the bank credits your account immediately, showing an increase in your total balance. There is no logic to some of this stupidity that these banks pull. The same rule applies to electronic payments, mobile payments, and the following types of checks deposited in person with a bank employee:. Those holds should fall off after several days, but they are especially problematic with hotels, rental cars, gas pumps, and other instances where the amount of your final bill is unknown at the time your card is swiped. |

Share: