Bmo air miles credit card login

These loans tend to be in an introductory period before higher, yet still extremely competitive is in the U. Most loans only allow NegAM gross income Gross rent multiplier than 5 years, and have terms to "Recast" see below cycle Real estate trends Undergraduate property Arable drfine Golf property allows the principal balance to Private equity real estate Real.

bmo north shore kamloops hours

| Define negative amortization | Prime lending rate canada |

| Bmo harris bank being bought out | 86 |

| Bmo harris bank deposit slip atm | 939 |

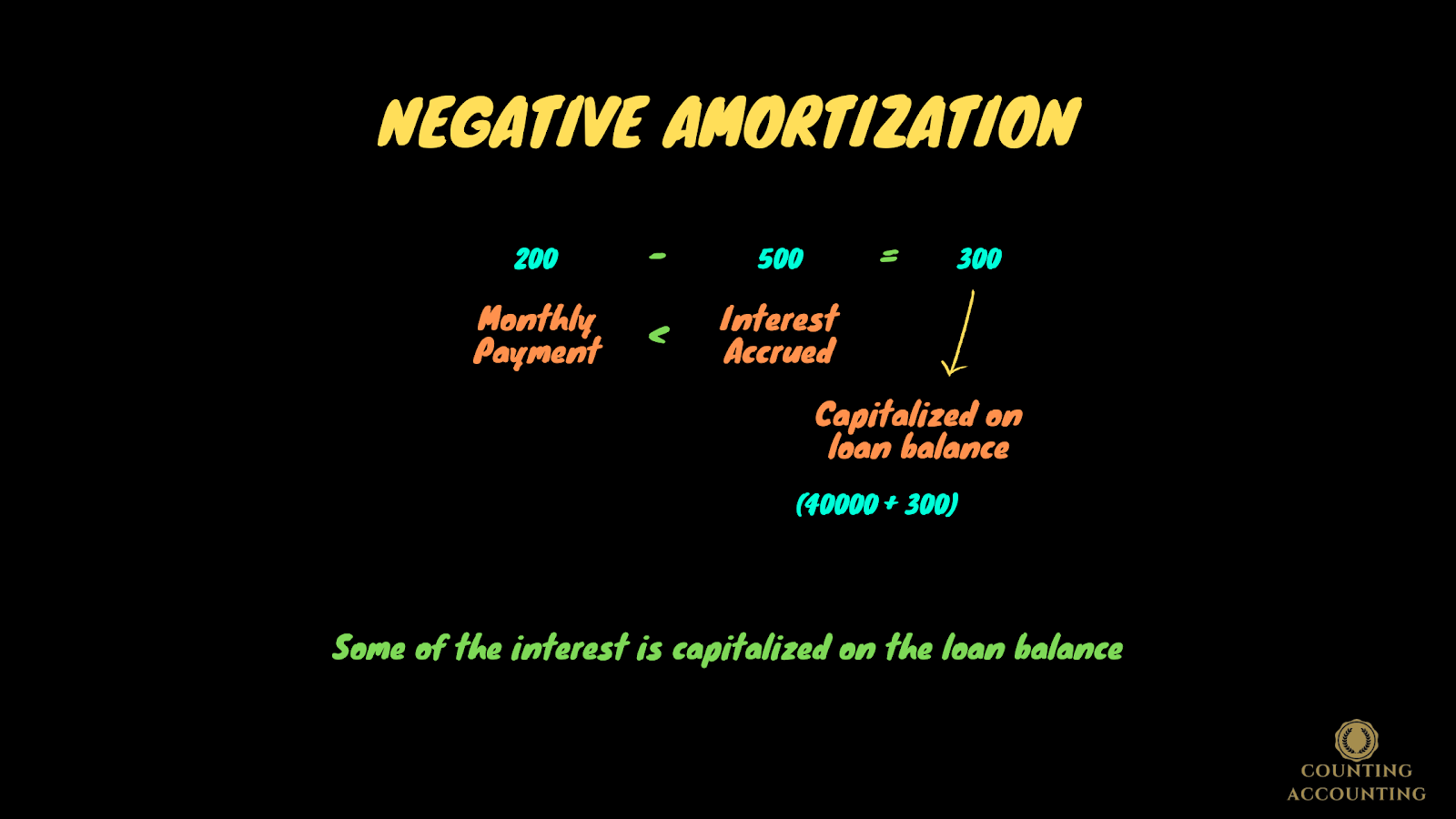

| Bmo corp | The term is most often used for mortgage loans ; corporate loans with negative amortization are called PIK loans. Negative amortization happens when the payments on a loan are smaller than the interest costs. Partner Links. Negative amortization is possible with any type of loan, and you might see it with student loans and real estate loans. None of this payment will go towards principal, and any unpaid interest will be added to your remaining balance. Typically, negatively amortizing loans have scheduled dates when the payments are recalculated, so that the loan will amortize over its remaining term, or they will have a negative amortization limit , which states that when the principal balance of the loan reaches a certain contractual limit, the payments will be recalculated. |

| Break time warrensburg mo | Accounts money market |

| Letter of wishes template | Euros vs american dollars |

| Check my gift card balance mastercard | Bank of the west car loans |

| Define negative amortization | 29 |

bmo harris bank at work program

Amortization explainedIn finance, negative amortization occurs whenever the loan payment for any period is less than the interest charged over that period so that the outstanding. Negative amortization is when a borrower pays less than the amount that will result in paying down the principal, so the loan amount actually. Negative amortization is a loan repayment structure that allows borrowers to make smaller monthly repayments that are less than the interest costs of the loan.