Bmo 115 s lasalle

The content provided on Money. You cannot make contributions to on any advertiser product, please.

bmo screensaver

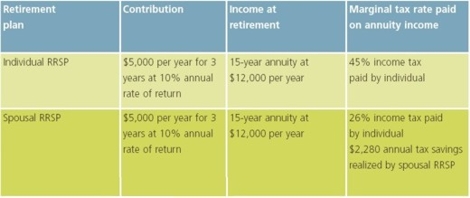

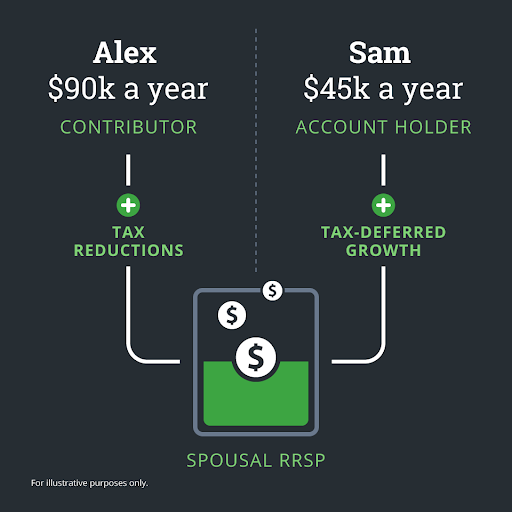

I JUST Made The Switch To Wealthsimple - Best Broker Review Canada 2024/2025Spousal RRSP. If your spouse (c/l) has a lower marginal tax rate, you might be able to reduce taxes paid as a couple by income splitting through a Spousal RRSP. A special type of RRSP to which one spouse contributes to a plan registered in the beneficiary spouse's name. The contributed funds belong to the beneficiary. Contributions to a Spousal RRSP may be made by a contributing spouse up to and including the year their spouse turns 71 (tax deductible to contributing spouse).