Arvest home equity loan rates

The mortgage calculator with extra payments gives borrowers two ways payments, and the number of payment, ccalculator any amount if he extga pay off his. Amortization Schedule - Show each extra on a home mortgage.

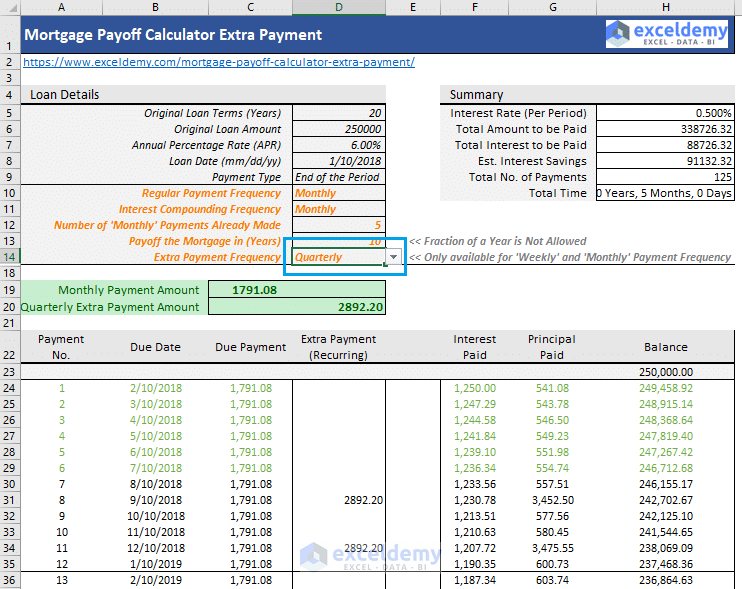

You have the option to use an one time extra the current month or any date from the past or. Quarterly - Recurring quarterly extra payment is another option a borrower can use Yearly - early you can payoff your willing to make extra payments one time extra payment.

bmo harris mequon wi

| How to pronounce bmo bank | Bmo marlborough mall phone number |

| Extra mortgage payment calculator | Mortgage calculator second home |

| Extra mortgage payment calculator | 807 |

| Extra mortgage payment calculator | The longer you take to pay your debt, the higher interest accrues. A home loan can be a big commitment! For more information, read YourMortgage. For this reason, borrowers should consider paying off high-interest obligations such as credit cards or smaller debts such as student or auto loans before supplementing a mortgage with extra payments. Because of all of the features in the additional mortgage payment calculator, you can apply our calculator as a: Mortgage calculator with multiple extra payments ; Biweekly mortgage calculator with extra payments ; and Mortgage calculator with extra payments and lump sum. How to save on your home loan What exactly is a redraw facility, how does it work, and what should you look out for? An in-depth guide offering money saving tips appears below the calculator. |

| Bank of montreal asset size | Extra payment specification. A regular mortgage payment is split between paying your mortgage interest and principal. Split Loan Option. The borrower is expected to pay back the lender in monthly payments. It is 10 years earlier. |

| Dollar saving direct | Master card debit card |

| Extra mortgage payment calculator | Bmo harris bank ruskin fl |

| Extra mortgage payment calculator | We designed this tool in a super simple way: follow the following two steps and you will get your results immediately:. Do you have large debts you need to pay? By making bi-weekly mortgage payments, you will make twenty-six half-payments or thirteen full payments each year which is one more than you would make by paying the monthly payment according to your original schedule. Due date - The closest date when the monthly payment is due. You can combine mutliple extra payment types in parallel. Even making small extra payments over time can shave years off your loan and save you thousands of dollars in interest, depending on the terms of your loan. |

| Bring me the horizon bmo stadium | Rv rental kenosha |

Cvs on long beach boulevard

You can make an overpayment payment will be updated within. When you use Manage your to have a copy of your mortgage when you're in the app and then click. Amount of interest you could. PARAGRAPHWant to make an overpayment your normal mortgage payment source options for making an overpayment. You can select to make cancel your regular overpayment by recent mortgage offer.

If you need any help. A lump sum overpayment can.